Maximizing Your Life Insurance Benefits In The United States

_Maximizing Your Life Insurance Benefits in the United States_

Life insurance is a crucial investment for securing your family’s financial future. It provides a safety net for your loved ones in the event of your passing, ensuring that they are financially protected and can maintain their standard of living. However, simply having a life insurance policy is not enough; you need to ensure that you’re maximizing your life insurance benefits to get the most out of your investment.

In this article, we’ll explore the ways to maximize your life insurance benefits in the United States, helping you make informed decisions about your policy and ensuring that your loved ones are financially protected.

Understanding Your Life Insurance Policy

Before we dive into maximizing your life insurance benefits, it’s essential to understand the basics of your policy. Here are a few key things to consider:

– *Policy type*: Is your policy term life, whole life, or universal life? Each type of policy has its own unique features and benefits.

– *Coverage amount*: How much coverage do you have? Is it enough to support your family’s financial needs?

– *Premium payments*: How much are you paying in premiums each month? Are you taking advantage of any available discounts or riders?

Maximizing Your Life Insurance Benefits

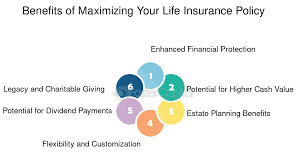

Now that you have a better understanding of your policy, here are some ways to maximize your life insurance benefits:

– *Add riders*: Riders are additional features that can be added to your policy to provide extra benefits. For example, a waiver of premium rider can waive your premium payments if you become disabled.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

– *Take advantage of tax benefits*: Life insurance proceeds are generally tax-free to the beneficiary. However, if you’re the policyholder, you may be able to deduct your premium payments from your taxable income.

– *Use your policy as a savings vehicle*: Some life insurance policies, such as whole life or universal life policies, can accumulate a cash value over time. You can borrow against this cash value or use it to pay premiums.

– *Consider a policy exchange*: If you have an existing policy that’s no longer meeting your needs, you may be able to exchange it for a new policy with better benefits or a lower premium.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specified period, usually 10, 20, or 30 years. It’s often less expensive than whole life insurance, but it doesn’t accumulate a cash value.

If you have a term life insurance policy, here are some ways to maximize your benefits:

– *Convert to a permanent policy*: If you have a term life insurance policy, you may be able to convert it to a permanent policy, such as whole life or universal life insurance.

– *Add a rider*: Consider adding a rider to your term life insurance policy, such as a waiver of premium rider or a disability income rider.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

Whole Life Insurance

Whole life insurance is a type of life insurance that provides coverage for your entire lifetime, as long as premiums are paid. It also accumulates a cash value over time, which you can borrow against or use to pay premiums.

If you have a whole life insurance policy, here are some ways to maximize your benefits:

– *Use your cash value*: Consider using your cash value to pay premiums or to supplement your retirement income.

– *Add a rider*: Consider adding a rider to your whole life insurance policy, such as a waiver of premium rider or a disability income rider.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

Universal Life Insurance

Universal life insurance is a type of life insurance that combines a death benefit with a savings component. It provides flexibility in premium payments and can accumulate a cash value over time.

If you have a universal life insurance policy, here are some ways to maximize your benefits:

– *Use your cash value*: Consider using your cash value to pay premiums or to supplement your retirement income.

– *Add a rider*: Consider adding a rider to your universal life insurance policy, such as a waiver of premium rider or a disability income rider.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

Conclusion

Maximizing your life insurance benefits requires a thorough understanding of your policy and a willingness to make adjustments as needed. By adding riders, increasing your coverage, taking advantage of tax benefits, using your policy as a savings vehicle, and considering a policy exchange, you can ensure that your life insurance policy is working hard to protect your family’s financial future.

Remember, life insurance is a long-term investment, and it’s essential to regularly review and update your

_Maximizing Your Life Insurance Benefits in the United States_

Life insurance is a crucial investment for securing your family’s financial future. It provides a safety net for your loved ones in the event of your passing, ensuring that they are financially protected and can maintain their standard of living. However, simply having a life insurance policy is not enough; you need to ensure that you’re maximizing your life insurance benefits to get the most out of your investment.

In this article, we’ll explore the ways to maximize your life insurance benefits in the United States, helping you make informed decisions about your policy and ensuring that your loved ones are financially protected.

Understanding Your Life Insurance Policy

Before we dive into maximizing your life insurance benefits, it’s essential to understand the basics of your policy. Here are a few key things to consider:

– *Policy type*: Is your policy term life, whole life, or universal life? Each type of policy has its own unique features and benefits.

– *Coverage amount*: How much coverage do you have? Is it enough to support your family’s financial needs?

– *Premium payments*: How much are you paying in premiums each month? Are you taking advantage of any available discounts or riders?

Maximizing Your Life Insurance Benefits

Now that you have a better understanding of your policy, here are some ways to maximize your life insurance benefits:

– *Add riders*: Riders are additional features that can be added to your policy to provide extra benefits. For example, a waiver of premium rider can waive your premium payments if you become disabled.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

– *Take advantage of tax benefits*: Life insurance proceeds are generally tax-free to the beneficiary. However, if you’re the policyholder, you may be able to deduct your premium payments from your taxable income.

– *Use your policy as a savings vehicle*: Some life insurance policies, such as whole life or universal life policies, can accumulate a cash value over time. You can borrow against this cash value or use it to pay premiums.

– *Consider a policy exchange*: If you have an existing policy that’s no longer meeting your needs, you may be able to exchange it for a new policy with better benefits or a lower premium.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specified period, usually 10, 20, or 30 years. It’s often less expensive than whole life insurance, but it doesn’t accumulate a cash value.

If you have a term life insurance policy, here are some ways to maximize your benefits:

– *Convert to a permanent policy*: If you have a term life insurance policy, you may be able to convert it to a permanent policy, such as whole life or universal life insurance.

– *Add a rider*: Consider adding a rider to your term life insurance policy, such as a waiver of premium rider or a disability income rider.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

Whole Life Insurance

Whole life insurance is a type of life insurance that provides coverage for your entire lifetime, as long as premiums are paid. It also accumulates a cash value over time, which you can borrow against or use to pay premiums.

If you have a whole life insurance policy, here are some ways to maximize your benefits:

– *Use your cash value*: Consider using your cash value to pay premiums or to supplement your retirement income.

– *Add a rider*: Consider adding a rider to your whole life insurance policy, such as a waiver of premium rider or a disability income rider.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

Universal Life Insurance

Universal life insurance is a type of life insurance that combines a death benefit with a savings component. It provides flexibility in premium payments and can accumulate a cash value over time.

If you have a universal life insurance policy, here are some ways to maximize your benefits:

– *Use your cash value*: Consider using your cash value to pay premiums or to supplement your retirement income.

– *Add a rider*: Consider adding a rider to your universal life insurance policy, such as a waiver of premium rider or a disability income rider.

– *Increase your coverage*: If your income or financial obligations have increased, you may need to increase your coverage amount to ensure that your family is adequately protected.

Conclusion

Maximizing your life insurance benefits requires a thorough understanding of your policy and a willingness to make adjustments as needed. By adding riders, increasing your coverage, taking advantage of tax benefits, using your policy as a savings vehicle, and considering a policy exchange, you can ensure that your life insurance policy is working hard to protect your family’s financial future.

Remember, life insurance is a long-term investment, and it’s essential to regularly review and update your

Leave a Reply